Deloitte Corporate Finance Norway

In Deloitte Corporate Finance, we provide M&A advisory to company owners, entrepreneurs and private equity clients. In close dialogue with our client, we handle every strategic, financial and tactical aspect of the process when either buying or selling a company.

We handle all the intensive workloads from the initial considerations to a successful sale

- Early Considerations

Reflections of a sale often arise from a shift in generations of the founding family or with the purpose of finding a partner to support future growth through experience and financial resources. An early dialogue helps to clarify motives and expectations for a potential sale. We assess the best possible exit strategy and design a customised process based on our client’s preferences.

- Internal Preparations

Preparing a company for a potential sale includes a discussion and review of business plan, growth opportunities and potential areas of improvement. This in close dialogue with both seller and management team. A thorough financial and commercial analysis can further strengthen the company in a transaction and is carried out in close collaboration with other advisers.

- Identification of Investors

The number of investors entering into dialogue within a sales process is based on a range of important considerations. We identify all relevant investors, both globally and locally, based on strategic fit, corporate culture, the ability to finance the investment, etc. Together, we decide on the appropriate strategy for a successful sale.

- Preparation of Sales Materials

The sales material is the first impression potential investors have of the company, which is why quality is essential. The material is prepared by us in close collaboration with the management team and highlights the key selling points of the company. Potential investors are provided sufficient information to submit indicative offers while ensuring that sensitive information is not exposed.

- Market

ContactWe handle all investor dialogues from the initial contact to the final negotiations. Essentially, it is important for the seller to connect with the relevant counterparties to discuss the future of the company. We prepare both seller and management team on relevant topics and make sure that they are well prepared for the dialogue.

- Negotiation and Final Agreement

We evaluate individual offers in close dialogue with our client and negotiate on their behalf. A successful sale is obtained when finding the best possible partner for the future journey of the company while securing an attractive price and favourable terms for the seller.

Reflections of a sale often arise from a shift in generations of the founding family or with the purpose of finding a partner to support future growth through experience and financial resources. An early dialogue helps to clarify motives and expectations for a potential sale. We assess the best possible exit strategy and design a customised process based on our client’s preferences.

Our team of dedicated M&A professionals advises on the strategic important decision when a client is looking to acquire a minority or majority stake in a company.

We have extensive experience from both sell and buy-side advisory, which enables us to provide the best possible bid and response tactics throughout the bidding process and final negotiations. Based on our distinctive sector knowledge we thoroughly analyse and value the acquisition target and potential synergies. This approach also supports an early identification and resolution of potential issues.

Strategic acquisitions can take a company to new heights by improving, extending or transforming the current business. We assist our clients in developing, prioritising and executing a solid M&A strategy. Our global reach and insight is valuable in identifying and initiating the dialogue with attractive acquisition targets.

Our business model is based on trust and has resulted in long-term client relationships.

Transactions

Tap on the tiles to read more

Exclusive financial advisor to Kinematic, Makin' 3D and Maskinstyring in the sale to Priveq

Exclusive financial advisor to ROQC Data Management in the sale to Hawk Infinity

Exclusive financial advisor to Baze Technology in the sale to Hawk Infinity

Exclusive financial advisor to Infranode in the acquisition of a 49% stake in Altifiber

Exclusive financial advisor to Frende Forsikring in the acquisition of the non-marine insurance business of Granne Forsikring

Exclusive financial advisor to First Fondene in the sale to Atle Investment Management, a portfolio company of Bure Equity

Exclusive financial advisor to CGE Partners and Inspera AS in the sale of subsidiary Kikora AS to Inkrement

Exclusive financial advisor to Maskinpakking in the sale to Hawk Infinity

Exclusive financial advisor to the shareholders of Data Equipment in the merger with Netsecurity

Exclusive financial advisor to the shareholders of Power ON in the sale to insightsoftware, a portfolio company of Hg, TA Associates and Genstar Capital

Exclusive financial advisor to Langset in the sale of Langset Energy to Bratseth Holding AS

Exclusive financial advisor to Infranode in the acquisition of Sola Bredbånd AS

Exclusive financial advisor to the shareholders of CICERO Shades of Green in the sale to S&P Global

Exclusive financial advisor to Infranode in the acquisition of a 49% stake in Tafjord Connect

Exclusive financial advisor to AnaCap Financial Partners in the acquisition of EDIGard AS

Exclusive financial advisor to Aktiv Veidrift AS in the sale to Green Landscaping Group AB

Advised Infranode and DIF Capital Partners in raising a long-term debt facility from BlackRock Real Assets in the refinancing of Velfra AS

Exclusive financial advisor to the shareholders of Customer Link AS in the sale to Axxelerator Capital AS

Exclusive financial advisor to Waterland in the sale of Envidan Selvkost (a subsidiary of EnviDan A/S) to Visma

Exclusive financial advisor to the shareholders of EVO in the sale to Karbon Invest AS

Exclusive financial advisor to Resight AS in the sale to Embriq

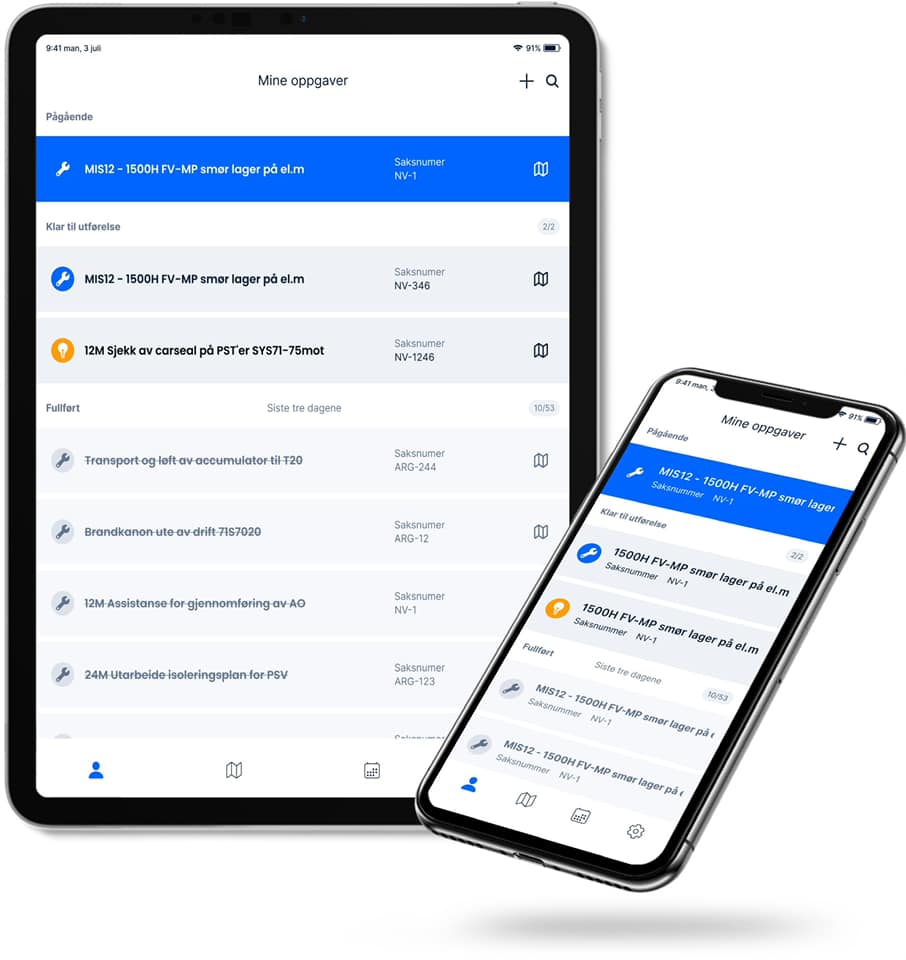

Exclusive financial advisor to Front Systems in the sale to EG A/S

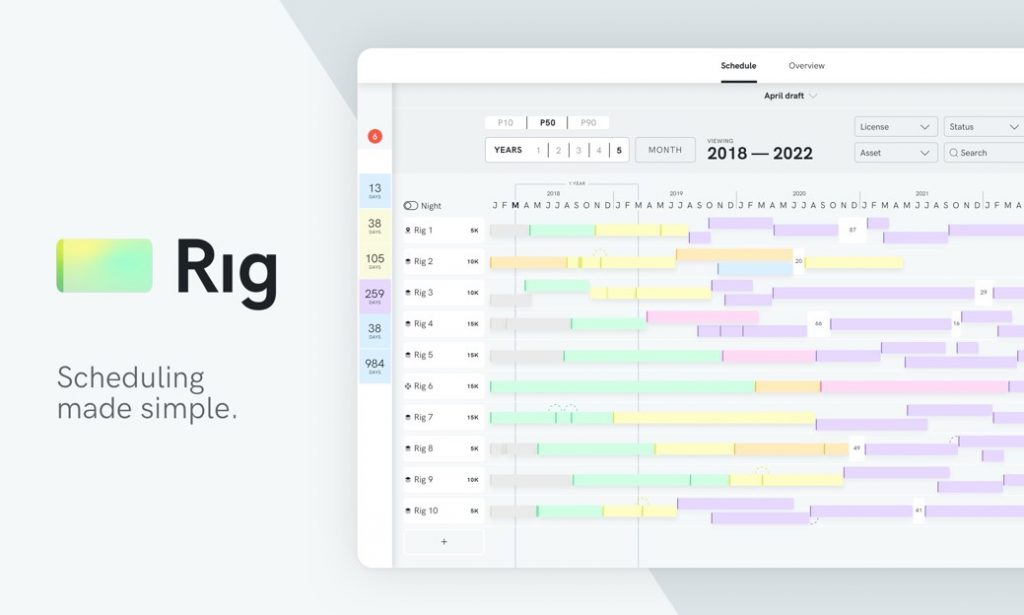

Exclusive financial advisor to Deloitte Digital in relation to the sale of its portfolio application ‘RIG’ to AGR

Exclusive financial advisor to Kaph Entreprenør in the sale to Polygon

Exclusive financial advisor to Holberg Fondsforvaltning in the sale to Carneo

Exclusive financial advisor to Hammersborg Eiendomsforvaltning (formerly Brækhus Eiendom) in the sale to OBOS

Exclusive financial advisor to Kraftfire AS in merging the electricity retail business of Sognekraft AS into Kraftfire AS

Exclusive financial advisor to Stord Innkvartering AS in the sale to Adapteo Group

Exclusive financial advisor to Nordlandsnett and Troms Kraft Nett in the merger of the two companies

Exclusive financial advisor to Hålogaland Kraft and Nordkraft in the merger of the two companies

Exclusive financial advisor to Arendals Fossekompani in the sale to OneCo

Exclusive financial advisor to Kanari Group (formerly Red Ocean) in the sale to Adelis Equity Partners

Advised Tafjord, SFE and Tussa in the merger of their electricity retail businesses

Exclusive financial advisor to Frende Forsikring in the sale of their pension product portfolio and associated risk products to Nordea Liv

Financial advisor to Easybank in relation to the merger with Brabank

Advised KLP in the acquisition of 33.33% of the shares in NEAS

Advised Nordvest Nett AS in the sale of their fibre business to Tafjord

Advised Selvaag Eiendom in the sale of Tjuvholmen Drift to Newsec

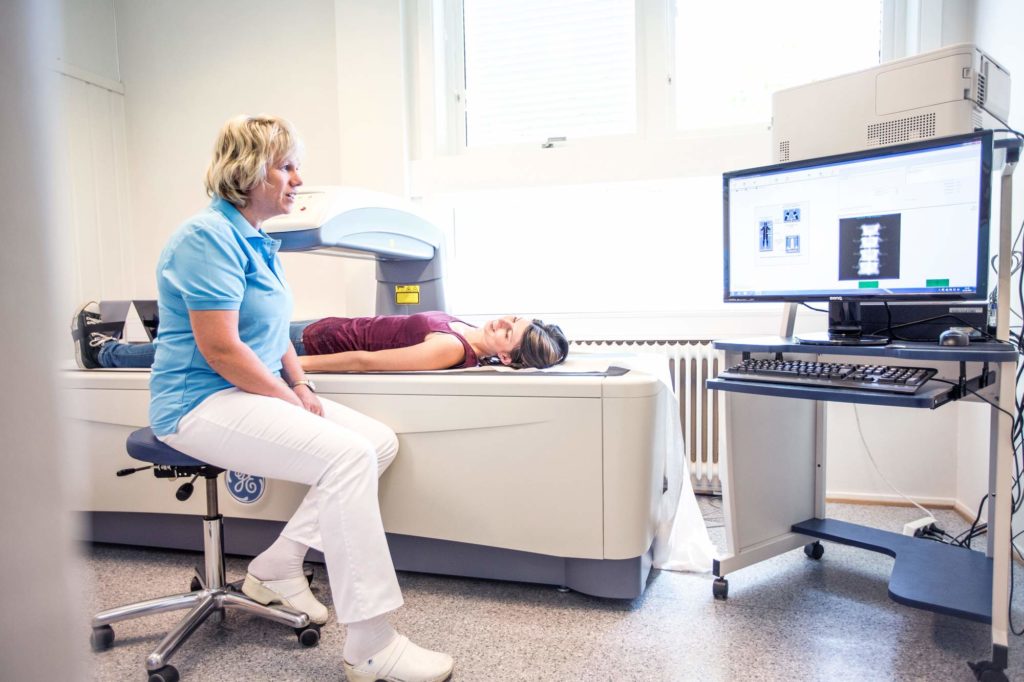

Advised M3 Helse in the sale to Credo Partners

Advised Ringerikskraft in the merger with Nore Energi AS

Advised Viking Life Saving Equipment in the acquisition of Norsafe

Advised Seniorstøtten in the sale to Vanadis Velferd

Advised Tysnes Kraftlag in the sale to BKK

Advised Nord Kapitalforvaltning in the sale of Rapp Marine to MacGregor

Advised Tussa Kraft in the acquisition of 49% in Istad

Advised Geia Food in the sale to Credo Partners

Advised Sans Bygg AS in the sale to a consortium led by Melesio

Advised minority shareholders in NOKAS in the sale to Triton Partners

Advised KLP in the acquisition of 15% in Lofotkraft

Advised Veidekke in the acquisition of a majority stake in Båsum Boring AS

Advised Glitnir in the sale of Nopco Paper Technology to Solenis

Advised Teknologisk Institutt in the sale to Kiwa

Advised Scandinavian Biogas in the acquisition of a majority stake in Biokraft AS

Advised Momentum Selvkost in the sale to EnviDan

Advised Norwegian Deck Machinery in the sale to Palfinger

Advised Mitsubishi in the acquisition of Gas & Diesel Power

Advised Telenor in the sale of certain assets to Otrum

Advised Lakrisgutta in the sale to Orkla

Advised Steinsvik in the acquisition of Ocea

Manager - share issue in Prediktor Medical of NOKm 50

Advised KLP in the acquisition of 10% in Trønder Energi

Exclusive financial advisor to Tafjord and Tussa in the merger of their two grid companies creating Mørenett

Advised Hepro in the sale to Nord Kapitalforvaltning

Advised Hurtigruten in the sale of Tirb to Boreal

Advised Assistermeg in the sale to team:olivia

Advised NOKAS in the acquisition of a alarm portfolio from Siemens

Advised Dolphin Invest in the acquisition of shares in Expert

Advised a buyer consortium in the acquisition of Ica Maxi

Advised Living in the merger with Skeidar

Advised BC Partners in the acquisition of Nille

Joint advisor to XXL in the sale to EQT